Tesla's sudden fall, is it all Musk's fault?

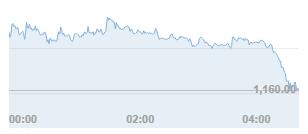

On November 7, local time, Tesla CEO Musk, the world’s richest man, launched a poll on social media asking 62.7 million fans whether he should sell 10% of Tesla’s stock (worth $21 billion, approximately 130 billion yuan). Musk also said that no matter what the result is, he will "obey the voting result."

The biggest black update is here!

After a week of brainless rise, the lying-win combination of the seven giants of TFAANMG has risen to a doubtful life. It seems that there is nothing to stop the rise of US stocks, but the dark tide is surging under calm.

If U.S. companies do not rise in stocks, U.S. stocks will soar by 40%?

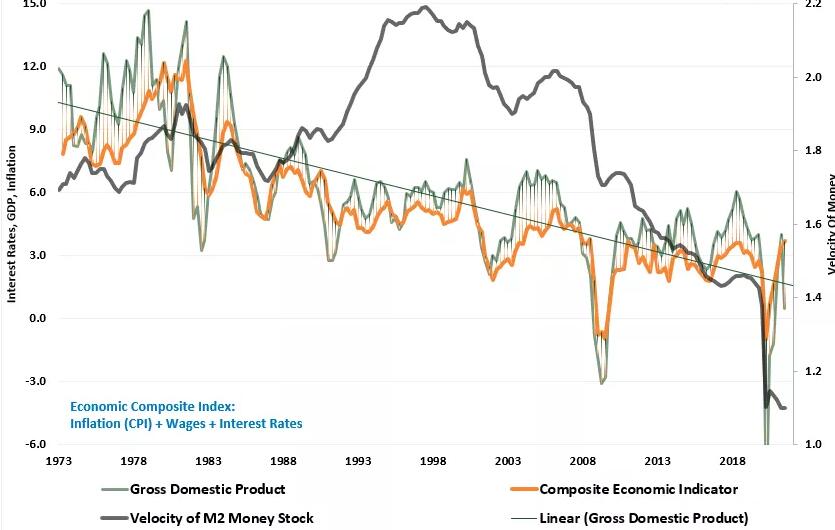

Speaking of the bull market in the U.S. stock market that lasted for more than a decade, the bulls will always cite a series of factors to provide legitimacy. The potential is all stocks bought back. Sounds crazy? But the reality is like this.

The stock price soared 78% in just one month. Can HTC still catch up?

Taiwanese mobile phone and tablet computer manufacturer HTC (TW:2498) (also known as HTC) announced its latest quarterly financial report on Tuesday (November 2). Due to its performance for five consecutive quarters, the company's stock price closed down 5.41% on Tuesday.

The meta-universe plot is popular all over the world, is it easy to hype or have a long-term perspective?

Recently, a new term has caught the eyes of most investors, and that is "Metaverse". All this stems from the sudden announcement of Facebook Facebook last week to change the company's name to Meta, which is the "Yuan" character of Meta Universe.

Welcome to the "Lie Win Era"

The expected financial report thunder has come. Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) have all delivered financial reports that are not as good as expected, but the market has not experienced violent turbulence and is still quite smooth.

Financial report anatomy | veteran empire Microsoft is still strong

This earnings season is particularly difficult to bet on. This is mainly reflected in the obvious differentiation of the giants, which is basically a song of ice and fire, and there are too many factors to consider.

The stock price plummeted 8% after the market. What happened to Robinhood, the "retail home base"?

Robinhood Markets Inc (NASDAQ: HOOD), a US stock broker known as the "retail investor base", announced its second financial report since its listing on Tuesday after the US stock market. Once the financial report was announced, Robinhood's stock price plummeted by more than 8% after the market, falling below the issue price.

U.S. stocks will face more downside risks before the end of the year

The US Standard & Poor's 500 Index hit a new high on Monday, but Bank of America said that the market may still experience a sharp decline by the end of this year.

Apple’s new system dragged Snap down 26%. Are Facebook and Twitter okay?

Last Friday, Snap (NYSE:SNAP), the parent company of Snapchat, the most popular social media platform for young people in the United States, plunged 26.59% in its stock price because of its previously announced earnings report that was less than expected.

Will U.S. stocks turn around again?

The three major stock indexes have experienced a week of consecutive gains, but they seem to come to an abrupt end on Friday. Next week will usher in the financial reports of the five major FAAMG giants, and a very volatile trading week is coming.

Squid games are hot, how long can Netflix's stock price fly?

Recently, a Korean survival thriller called "The Squid Game" quickly became popular all over the world after it was released. Only one month after its launch, the show has become the most-viewed original show by Netflix (NASDAQ: NFLX).

Have to guard! US stocks welcome two major risks

Recently, U.S. stocks have continued their upward offensive after a wave of corrections. It is believed that it will not take long for the major U.S. stock indexes to regain lost ground and even reach new highs. However, two potential risks in the near future are worthy of investors' attention.

Before the commission of the US government, the US stock market was "extremely high."

October is the stock market curse?

Even the female stock gods have begun to sell, is Tesla exhausted?

He became famous by focusing on Tesla, and the founder of the Ark Investment Company, known as the "women stock god" and "women Buffett," "Wood sister" Casey Wood has always been a firm vocalist in technology stocks, but recently it has been exposed. Frequent sell-offs of Tesla (NASDAQ:TSLA) stocks.

Reddit goes public: The spiritual ranger of retail investors, has begun to embrace capitalists?

At the beginning of this year, with the enthusiasm of the "national stock market", a show was staged on the other side of the Atlantic, where retail investors and Wall Street were at their peak.

Run if you earn? The funds were concentrated to escape the brokerage ETF, and more than 3 billion copies were redeemed in 6 trading days!

With the continuous rise of the brokerage sector since August, funds have begun to consider taking profits.

This blue chip stock with a dividend of more than 5% is expected to take off in the near future?

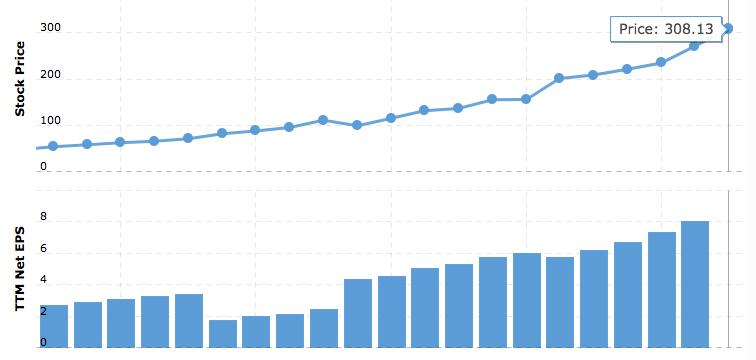

To be honest, IBM (NYSE:IBM) is not a "hot chicken" on Wall Street, and unlike some other technology stocks, it can firmly attract investors' attention. Unlike other blue-chip stocks, this 109-year-old company is trying to restore performance growth and is trying to compete with other companies in an environment where it has fallen far behind.

Oversupply of chips in the future? Steady Broadcom does not seek explosive growth in performance

In the past two years, facts have proven that investors who bet on chip stocks have become big winners. Chips are used in notebook computers, mobile phones and data centers, and their demand broke out during the pandemic, and global high-end chip manufacturers are even unable to meet the demand.

This leading media company introduces sports betting, high growth is just around the corner

So far this year, investors who own sports streaming platform Fubotv Inc (NYSE:FUBO) have experienced a turbulent year. Although the company's share price has risen by about 4% this year, it has since reached an all-time high of $62.29 in December 2020. , The company’s share price has fallen by more than 53%, and its current market value is $4.1 billion.