If U.S. companies do not rise in stocks, U.S. stocks will soar by 40%?

Speaking of the bull market in the U.S. stock market that lasted for more than a decade, the bulls will always cite a series of factors to provide legitimacy. The potential is all stocks bought back. Sounds crazy? But the reality is like this.

In the ultra-low interest rate environment of the past decade, it is normal for companies to borrow money to repurchase their own stocks, or strictly speaking, "abuse" repurchase. In fact, this is also a clear example of the fact that too low interest rates will undermine the enthusiasm of economic activities.

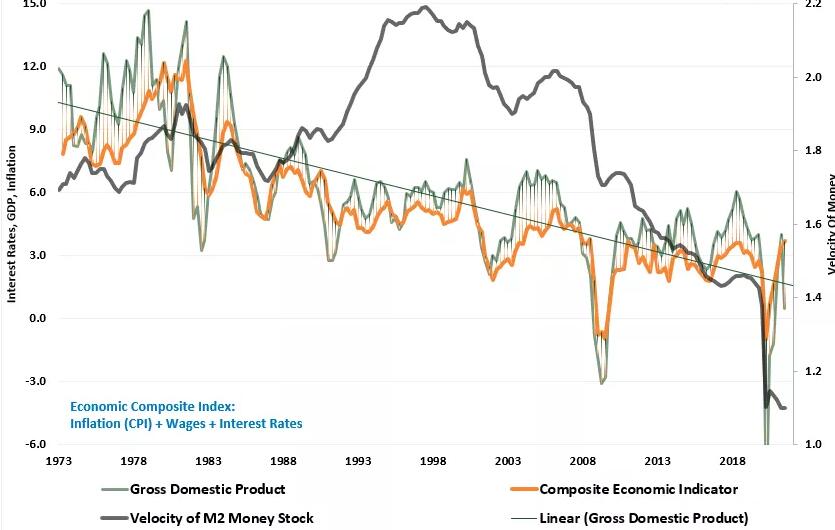

Due to ultra-low interest rates, companies have become increasingly reluctant to "invest". As the chart below clearly shows, in recent years, economic growth has become weaker and weaker as the rate of currency turnover has continued to decrease.

The sharp decline in currency turnover rate is a clear indication that the "economic transmission system" has failed. One of the most essential supporting factors for economic activity is bank lending to enterprises.

However, as shown in the figure below, the bank's loan-to-deposit ratio has fallen sharply like the currency turnover rate. In the final analysis, in the ultra-low interest rate environment, banks still face default risks when lending money, but the returns are almost negligible. How can they get any motivation?

When the economic environment shows an overall weakness, companies will inevitably face the situation of weak revenue growth. In this case, considering the significant impact of corporate stock prices on various executive compensation plans, they finally decided to use the cash in their hands to repurchase stocks to realize short-term benefits, rather than focusing on long-term capital investment. That is the logical result.

Interpretation of repurchase operation logic

Although literally, the concept of "stock repurchase" seems to be extremely clear, but its substance is much more complicated than literally. Let's make a hypothetical example analysis below:

A company has an annual profit of $1, and a total of 10 shares are outstanding. The company’s earnings per share is $0.1. The company decided to repurchase five outstanding shares with all of its $5 cash on hand.

In the second year, the company’s earnings were still US$1, but as the number of outstanding shares halved, the earnings per share doubled to US$0.2. As the earnings per share rose sharply, the stock price also rose.

However, since the company's cash is used to repurchase stocks, naturally there is no money to invest in the future development of its own business. Therefore, in the next year, the company's earnings will still be $1, and the earnings per share will still be $0.2. Due to zero growth, stock prices fell.

Of course, this analysis can be described as extremely simplistic, but it is enough to show that stock repurchase is only a one-off operation for the company, which helps limited operations.

Because of this, people will see that when a company repurchases stocks, they often fall into the trap they have dug. They must continue to repurchase stocks to ensure the latter's high price. The trouble is that doing so means that funds that should have been invested in long-term growth and productive investment will be continuously diverted.

The reason why these companies are willing to do this is actually very simple: the stock-based compensation mechanism.

Today, a large part of the remuneration of many corporate executives is tied to the performance of the company's stock, and its proportion is far greater than ever before. As a result, if a company misses Wall Street's profit expectations, it means that the company's stock will fall, and it means that the salary of these executives will be reduced.

According to the "Wall Street Journal" survey, 93% of corporate respondents said that they would use various methods to manipulate profit figures, either in order to "influence the stock price" or because of "external pressure." All in all, in recent years, stock repurchase operations are becoming more and more common in the corporate world. After the economy was shut down due to the epidemic last year, the repurchase intensity has increased astonishingly.

There is no return on capital

In essence, stock repurchase is simply the company giving cash to the individuals who sold the stock. This is an open market transaction. If Apple buys back some of its stock, then only those who sell the stock will get capital.

So, who are these most important stock sellers?

As mentioned earlier, the answer is corporate insiders. With the tremendous changes in the salary structure since the turn of the century, their remuneration is now largely based on stocks, and they will also regularly sell their awards. Stocks, turning them into tangible real money. As the "Financial Times" once pointed out:

"The management of the company has come up with many arguments as the reason for their repurchase of stocks, but none is really as clear and powerful as this simplest fact-the bulk of their income is based on stocks, and in the short term, stocks Buybacks will push up stock prices."

Yahoo Finance also reported that a recent research report released by the China Securities Regulatory Commission came to a similar conclusion:

"The CSRC's research found that many corporate executives have dumped a large number of company stocks they own after the company's stock repurchase."

Obviously, the misuse and abuse of stock repurchase methods to manipulate profits and essentially profit for insiders has become a common problem in the US stock market. The famous financial writer and media person John Authers also recently pointed out:

"For most of the past ten years, companies have continued to buy their own stocks, resulting in a substantial net decrease in the number of stocks. The amount of funds invested by companies in stock repurchases has even exceeded that during the same period. The scale of funds used to purchase bonds. The same thing is that both are pushing up asset prices."

In other words, while the US Federal Reserve is injecting an amazing amount of liquidity into the financial market, companies are also buying back a large number of their own stocks—to a large extent, there are no other important buyers in the market.

So, how big is the scale of the company's repurchase?

U.S. equity should be 40% lower than it is now