Risk aversion concerns overwhelmingly weak data, the end of Golden Week is looking to bottom out

Last trading day Wednesday (December 1st): International gold London gold rose and fell still closed. Once again leaving a long upper shadow at a relatively low level, it implies that the market outlook is limited and the market is about to bottom out and rebound.

Commodity giant Trafigura: very optimistic about oil and gas prospects

As one of the world's largest commodity trading companies, Trafigura Group (Trafigura Group) said that due to the difficulty of supply to keep up with rapidly growing demand, global oil and gas prices will be higher this winter and beyond.

How much impact did the US hurricane have on the oil market?

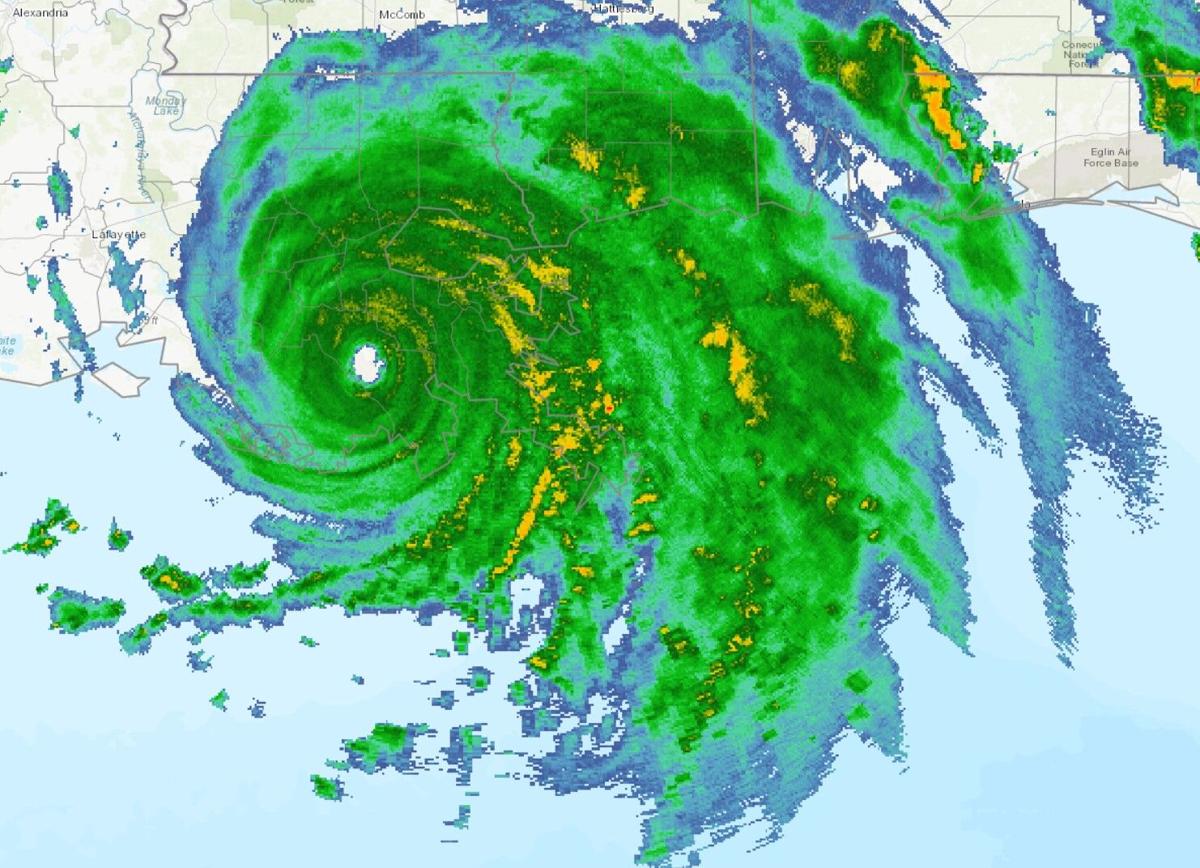

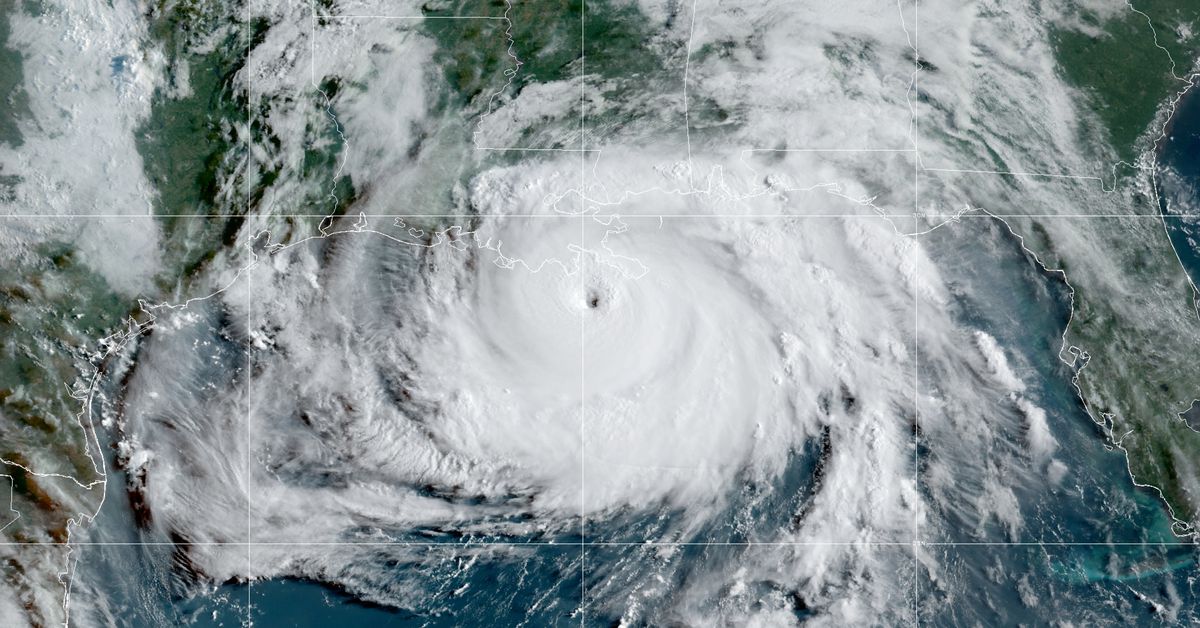

Hurricane Ida violently hit the heartland of the US energy industry, but the crude oil market reacted flat on Monday, and some oil companies began investigating the extent of the damage caused by the storm.

Hurricane "Ada" struck, crude oil production was cut, and oil prices rose sharply

In the early morning of last Sunday, the Louisiana Offshore Oil Port (LOOP) announced the suspension of crude oil transportation due to Hurricane Ida. In addition, oil and gas exploration and exploitation companies in the U.S. Gulf of Mexico and refining and chemical plants along the coast have stopped production in preparation for Hurricane Ida.

The gold rebound path is clear!

This week, gold fluctuated within a narrow range, with a weekly fluctuation of only $26. This kind of performance has been relatively rare in the past two years. The market is waiting for further clarification of the news.

The Middle East "Black Swan" is coming? Iran nuclear talks may be postponed to September

With the new Iranian President Lacey taking office, Iran has expressed its readiness to resume nuclear negotiations with world powers in Vienna, including indirect negotiations with the United States.

The real interest rate of U.S. Treasuries hit a record low, why didn't the price of gold rise?

The divergence between the gold price and the real interest rate trend of U.S. Treasuries since June of this year is confusing. As shown in Figure 1, the real interest rate of the 10-year U.S.

Risks The current market is temporarily sitting on the sidelines, and the prospects for gold price consolidation are still strong

The last trading day Tuesday (August 3rd): The international gold London gold once again oscillated and closed down.

Risks The current market is temporarily sitting on the sidelines, and the prospects for gold price consolidation are still strong

The last trading day Tuesday (August 3rd): The international gold London gold once again oscillated and closed down.

In terms of trend, the price of gold has opened at US$1812.87 since the Asian market in early trading, and has remained within the range of US$1808-1812 for most of the time.

Delta is rampant and inflation is high. What is the mid- to long-term outlook for gold?

In recent times, there has been no obvious trend in the gold market, and the overall trend is still dominated by shocks. Today, I will briefly talk to you about the medium and long-term trend of gold. Now the market mainly has these several focuses:

How many big mountains are there for international crude oil to capture 80 US dollars?

The US API crude oil inventories fell by 4.728 million barrels in the week to July 23, which is expected to decrease by 3.433 million barrels. In terms of data, API inventory fell again after a brief rebound, and it was 1.295 million barrels more than the expected decline.

Gold was under pressure and fluctuated and closed down, The U.S. decides that the bulls still show buying interest next week

Gold market trading day (July 19-23) week: International gold London gold oscillated and closed down, further showing pressure.

U.S. dollar and U.S. debt cover risk aversion support, and gold jumps up and down under pressure

Tuesday of the last trading day (July 20): International gold London gold rushed higher and fell back and then closed down. Although Monday’s bottoming and rebounding strength continued, but it is difficult to last.

Why did commodities plummet?

There was a collective collapse in commodities. What happened? Just as the market was worried that China's overall cut in reserve reserve ratio might aggravate the rise in commodity prices, the commodity market ushered in a sharp drop on Monday, and crude oil prices were the first to bear the brunt.

Inflation in the United States is at a record high. Can gold rise again? This is the key!

The US June Consumer Price Index (CPI) announced this week rose by 5.4% year-on-year, higher than the expected 4.9%, and hit the highest level since 2008.