The stock price plummeted 8% after the market. What happened to Robinhood, the "retail home base"?

Robinhood Markets Inc (NASDAQ: HOOD), a US stock broker known as the "retail investor base", announced its second financial report since its listing on Tuesday after the US stock market. Once the financial report was announced, Robinhood's stock price plummeted by more than 8% after the market, falling below the issue price.

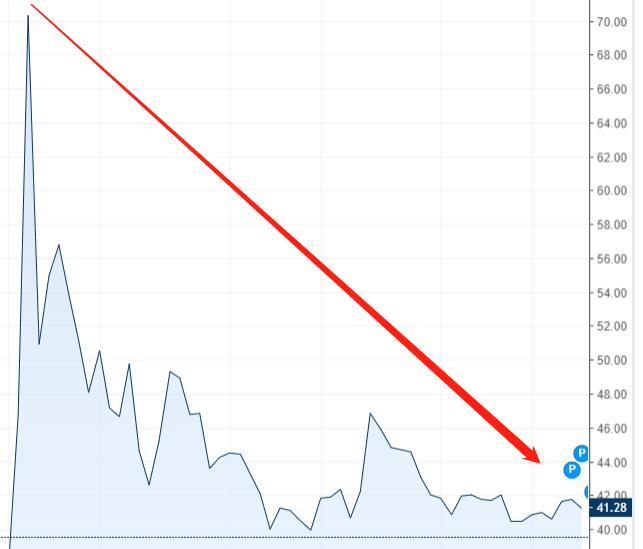

In late July, Robinhood officially landed on the capital market, riding the east wind of the retail group boom. In the first few days of listing, the company was sought after by investors, and the stock price once climbed to around $85. However, the good times did not last long. Robinhood's stock price fluctuated downward after setting a record high stock price on August 4, and the stock price has fallen more than 50% from its historical high.

Therefore, we might as well take a look at how Robinhood’s earnings performance is and how the company’s market outlook develops?

Cryptocurrency revenue growth is sluggish, and net losses have greatly expanded

In terms of revenue, Robinhood’s latest data shows that revenue in the third quarter increased by 35% year-on-year to US$365 million, but fell 35% from the previous quarter; the third-quarter net loss was US$1.32 billion, compared with a net loss of US$11 million in the same period last year. A substantial year-on-year expansion; the diluted loss per share in the third quarter was 2.06 yuan, higher than the market's expected loss of 67 cents per share.

Among them, the revenue from cryptocurrency was 51 million U.S. dollars in the third quarter, an increase of 860% year-on-year, but compared with the second quarter's 233 million U.S. dollars, the quarter-on-quarter decline was 78%. At the earnings conference, Jason Warnick, the company's chief financial officer, said in a conference call that customer attention in the third quarter shifted more from cryptocurrencies to stocks. "In the second quarter, the performance was about cryptocurrencies, especially Dogecoin."

Looking back at the third quarter, Dogecoin fell 20% cumulatively, which is in sharp contrast with the 372% surge in the second quarter.

The popularity of "MEME" stock trading and Dogecoin has gradually declined, and Robinhood has also begun to slow down in terms of user data. In the third quarter, financing accounts fell from 22.5 million in the second quarter to 22.4 million, and monthly active users also fell from 21.3 million in the second quarter to 18.9 million.

It is worth noting that Robinhood’s fourth-quarter performance guidance is slightly pessimistic. It believes that the factors affecting the company's third-quarter revenue growth will continue. The company believes that "lower trading activity" may result in revenue not exceeding US$325 million in the fourth quarter and annual revenue not exceeding US$1.8 billion. The new financing account in the fourth quarter will be the same as the new financing in the third quarter. The accounts are roughly the same (that is, about 660,000 newly added).

The PFOF regulatory hammer has not yet fallen, Robinhood's future is uncertain

For Robinhood, its main business model Order Flow Payment (PFOF) has been the company's biggest controversy since its listing.

Payment for order flow (PFOF, Payment for order flow) means that the broker forwards the user's stock, options and cryptocurrency orders to the high-frequency trading market maker for execution, thereby obtaining returns or compensation.

Although most brokers make profits from this business model, Robinhood is obviously more dependent on this business model. Data shows that the company's revenue through PFOF in the second quarter of this year accounted for 79% of total revenue.

However, after experiencing this year's tragic retail air-squeeze war, PFOF has entered the vision of American regulators.

In late August of this year, Gary Gensler, chairman of the US Securities and Exchange Commission (SEC), said that he did not rule out a total ban on order flow payments. In a report recently released by the SEC on the structure of the stock and options market in early 2021, the SEC focused its attention on order flow payment (PFOF). The report pointed out that US stock brokers have increased their income through controversial order flow payment industry practices, and are turning stock trading into a game to encourage investment activities of retail investors.

Robinhood also issued a warning to investors in the documents submitted in early October, "Any new or enhanced regulatory measures for PFOF may increase our compliance costs, thereby greatly reducing our transaction-based revenue, and will also lead to us. It is even more difficult to expand the source of customers in certain legally regulated areas."

Although there are many accusations against PFOF in the market, the SEC has not yet taken any action on it. Gary Gensler said last week that the SEC is working to determine whether it needs to reform or ban order flow payments. The market predicts that it may take several months for the SEC to make a final decision on how to regulate order flow payments.

According to the worst-case scenario, if the SEC bans the PFOF business model, it will be difficult for Robinhood to make up for its lost revenue without completely changing its business model. For this broker, this may be a disaster.

However, Thomas Peterffy, founder of Interactive Brokers, is very optimistic about the future of PFOF. He commented that the SEC will not ban the PFOF business model. "If they (SEC) ban PFOF, what must happen is that market maker Citadel Securities will choose to acquire Robinhood, and the two companies will merge into one."