The Fed releases pigeons again: how long can it last?

At 2 o'clock in the morning on July 29, the Federal Reserve once again issued a dove voice.

Why is it said that a decline in Starbucks is a good buying opportunity?

On social media, under a piece of information about Starbucks' (NASDAQ:SBUX) stock price drop overnight, netizens commented: "This is another buying opportunity."

Nike has entered a rapid growth cycle, and the stock price still has more room to rise in the market outlook?

In the past few months, the stock price of sportswear giant Nike (NYSE:NKE) has seen an amazing rebound.

Nike has entered a rapid growth cycle, and the stock price still has more room to rise in the market outlook?

In the past few months, the stock price of sportswear giant Nike (NYSE:NKE) has seen an amazing rebound.

Apple’s earnings report hits the market may underestimate its “report card” this year

Apple (NASDAQ: AAPL) will announce its financial report after the market on July 27 (Tuesday). Investors expect Apple’s performance to exceed market expectations once again, achieving record revenue again.

Will US stocks be dragged down by Delta? Massive financial report will give clues this week

Since the US holiday at the beginning of this month, the new crown virus in the United States has been on the rise, and now, people have to admit that the Delta virus has appeared on the "summer party".

FAAMG financial report intensively announced, focusing on Fed FOMC

As of Friday, 24% of the S&P 500 constituent stocks have announced 21Q2 results. Overall profit increased by +74.2% year-on-year, and revenue increased by +20.9% year-on-year, the fastest growth rate since the 2008 financial crisis

Twitter and Snap's earnings report are good. Will your social media peers stabilize next week?

Before welcoming the intensive earnings reports of technology stocks next week, the earnings reports of Twitter (NYSE:TWTR) and Snap (NYSE:SNAP) on Thursday were a prelude, giving investors more confidence in the earnings data of technology stocks next week.

Abbott’s Q2 earnings forecast: The new crown testing business has never been a “long-term business”?

Medical giant Abbott (NYSE:ABT) will announce the latest quarterly financial data before the US stock market on Thursday.

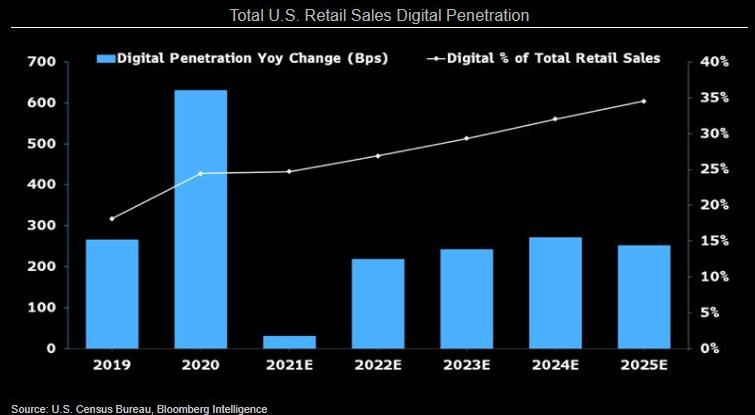

US$2 trillion is making strides into U.S. stocks

Previously, due to the increasing number of new cases of the global epidemic and the rampant Delta mutant strains, market risk appetite decreased and risk aversion sentiment surged. The U.S. stock market was sold off and plummeted, and funds poured into safe-haven assets such as U.S. Treasuries.

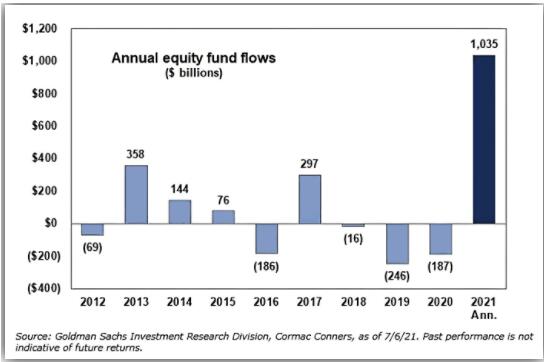

A terrible sign: "retailization" of hedge funds

Hedge funds have always been regarded as one of the most professional investment groups in the market, so their management costs are much higher than those of ordinary actively managed funds or index genes. However, in the past two years, retail investors are best at "chasing the rise and killing the fall" began to spread. To hedge funds.

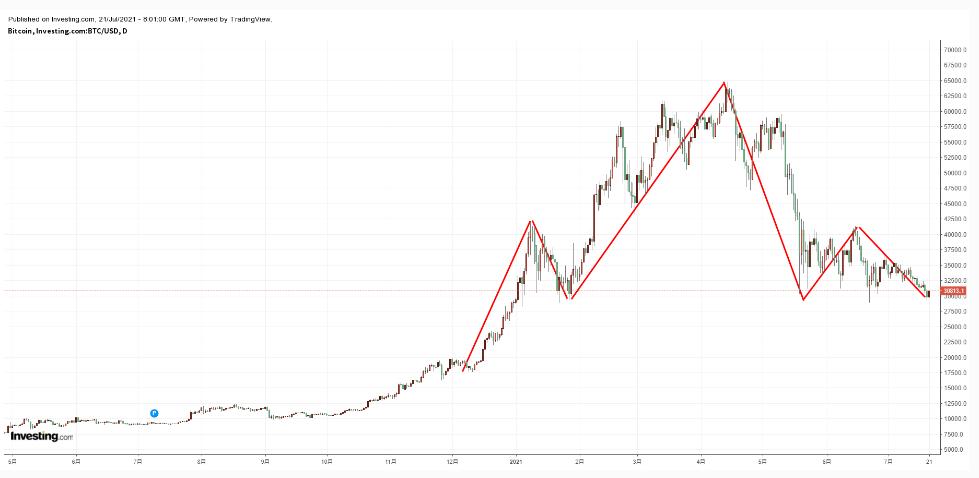

Unexpectedly, Tesla eventually planted on Bitcoin

According to US media statistics, at the beginning of this year, Tesla CEO Musk bought 46,000 bitcoins at an average price of $32,600. In the first quarter of this year, he sold 10% of his bitcoin holdings at a price close to historical highs of US$59,100, or 4600 bitcoins, bringing in revenue of US$272 million, and achieved 1.01 in the first quarter. Billion dollars in pre-tax profit.

Catering "big cattle" Mexican barbecue Q2 earnings report is good, the stock price is expected to reach a new high?

After the US restaurant stock Mexican BBQ Company (NYSE:CMG) announced its better-than-expected latest earnings report after the US stock market on Tuesday, its stock price soared more than 4% to US$1642.99

Wall Street has been taking the wrong direction recently? U.S. bond yields may continue to fall

U.S. Treasury yields continued their decline on Monday to a five-month low. Because of the new wave of pandemic concerns under the Delta virus, risky assets are under pressure, and investors have turned to hedging in bonds.

What are the major Wall Street firms doing in Q2? Selling stocks, buying bonds, and buying cash

As early as March this year, the market briefly paid attention to the fate of the supplementary liquidity ratio one year after the new crown virus pandemic, but it did not cause market volatility and was quickly forgotten by most people, except for Wall Street.