Gold loses its two major advantages, can the price of gold still be saved?

Gold is one of people's favorite jewelry and the oldest trading medium. It has the properties of value preservation and appreciation, can fight inflation, and has the effect of hedging risks. But recently, the two attributes of gold seem to be slowly disappearing.

Gold's anti-inflation function declines

Generally speaking, when the inflation rate continues to rise and the currency continues to depreciate, the role of gold in value preservation will appear.

Recently, Fed Chairman Powell said that “temporary” should not be used to describe inflation. High inflation is expected to continue until mid-2022.

On Tuesday, the November Producer Price Index (PPI) announced by the United States jumped 9.6% from the same period last year, far exceeding the 8.6% in October and also exceeding the expected 9.2%, and setting the largest year-on-year increase in 11 years. This supports the view that inflation may remain at a disturbingly high level for some time.

However, after the data was released, the price of gold fell instead of rising, dropping by more than 1% at one time.

High inflation in the United States has been going on for a long time. On November 10th of last month, the United States announced that the non-seasonally adjusted CPI annual rate in October was 6.2%, a new high in more than 30 years; the non-seasonally adjusted core CPI annual rate in October was 4.6%, a new high in 30 years. The price of gold rushed back and fell. After a few days of turbulence, it began to fall sharply, and fell below the $1,800 mark in one fell swoop.

Not only the United States, but global inflation is rising. Data just released on Wednesday showed that the UK CPI rose 5.1% year-on-year in November, which exceeded market expectations and was the highest since September 2011. Excluding price-volatile items such as energy, the core inflation rate also climbed to 4%, the highest level since 1992.

The Eurozone inflation rate accelerated to 4.9% in November, the highest level since the data was compiled in 25 years, higher than the 4.1% in October and far higher than the market estimate of 4.5%.

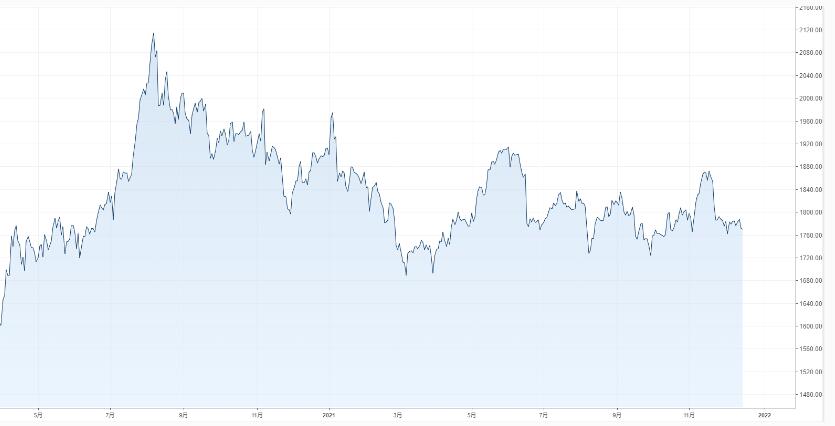

Since the beginning of this year, due to the impact of the epidemic and the crisis of the supply chain, the prices of raw materials have soared, housing prices, consumer goods and other prices have also soared, and the global inflation rate has continued to rise. So far this year, the price of gold has fallen by 6.86%, and the role of gold as a hedge against inflation has not been reflected at all.

Gold's hedging function declines

At present, the market’s risk aversion is mainly due to the uncertainty brought about by the epidemic.

On November 25, the Ome Keron virus was discovered in South Africa and immediately spread to dozens of countries around the world. Many countries announced blockades. The market was once in panic. Investors sold stocks, risky currencies, crude oil and all other assets and bought large quantities. Into safe-haven assets such as treasury bonds, yen, and Swiss francs, but gold does not seem to be taken seriously.

Gold showed a trend of rising and falling, and closed basically flat. Even investors would rather buy U.S. dollars to hedge than buy gold.

Moreover, huge risk events are often temporary, and the inflow of safe-haven funds usually comes and goes quickly, and is usually not the main factor affecting the price of gold.

The impact of interest rates

As gold is an interest-free product, the increase in interest rates of major central banks will reduce its attractiveness.

As global inflation continues to rise, major central banks have successively heard voices that they are beginning to tighten. The Bank of New Zealand has raised interest rates twice in a row, the Bank of Canada has also ended asset purchases, and the Federal Reserve is about to embark on the path of monetary policy.

Early on Thursday morning, the Federal Reserve will announce the last interest rate decision of the year. Not surprisingly, this will be a more hawkish meeting. The Fed may accelerate the pace of reduction, and even hint that it will raise interest rates early, which may once again suppress gold prices.