After the panic index soars by 50%, will the "Santa Claus market" come in December?

Under the dual effects of the Fed’s tightening and the new crown mutation virus Omicron, US stocks used to have good returns in December, but they are now in a high degree of uncertainty and volatility, and the VIX index, which is used to measure volatility, has also recently appeared. Skyrocketing.

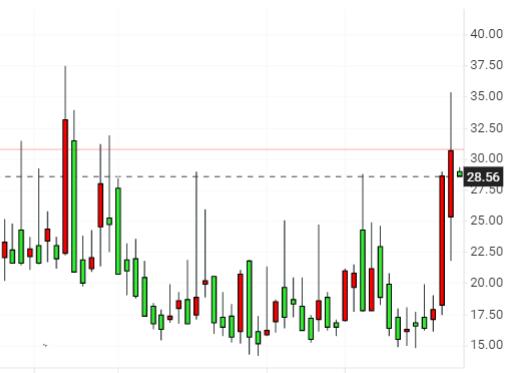

According to the market data of Investing.com, in the week of November 21 (specifically, the "Black Friday" on November 26), the VIX panic index soared 59.80%, and it continued to rise by nearly 10% last week. %, which has now fallen back to 29.15 points.

Generally speaking, the rise of VIX means that the volatility of the stock market will increase, and some investors will choose to withdraw funds at this time to avoid US stocks. After a week after the U.S. stock market experienced a "roller coaster" market, investors have more reason to suspect that U.S. stocks will enter December.

Savita Subramanian, an analyst at Bank of America, a major Wall Street investment bank, also recently released a report stating that the "Santa Claus rally" may not arrive as expected this year.

Entering December, the challenges that U.S. stock investors need to face mainly come from the Federal Reserve and the new crown epidemic.

Among them, Fed Chairman Powell said last week that the central bank plans to end the debt reduction process ahead of schedule, and that the current inflation can no longer be described as "temporary", which also triggered market speculation about early interest rate hikes.

According to the Fed's interest rate observer, the market has advanced the time for the first interest rate hike to May 2022. The market currently expects that the probability of a rate hike in this month has exceeded 50%, and a week ago it was still about 30%. .

The data is also supporting the Fed. In the November non-agricultural data released last Friday, although the employment growth was lower than expected, the unemployment rate fell to about 4.2%, the lowest level since February 2020, and wages have also risen. In addition, US service industry activities The index hit a record high in November. Steve Sosnick, chief strategist at Interactive Brokers, an investment agency, also said that “there is not enough evidence in the employment report to prevent the Fed from accelerating the reduction of debt purchases, and the door for raising interest rates faster than market expectations is still open.”

Bank of America analyst Savita Subramanian pointed out that although the average return of U.S. stocks in December has been 2.3% since 1936, extreme situations such as December 2018 are still likely to occur. Concerns about the economy, US stocks plunged by 7.6% in December of that year. When the time comes to December 2021, the situation is similar. The sudden change in the Fed’s position and the high valuation of the stock market may pose a threat to U.S. stock investors. She said, “I think in the short-term Or within the next 12 months, there is a high probability that U.S. stocks will pull back by 10%."

The man also pointed out that another risk factor that may slow growth is that “inflation has caused consumption to be hit, especially when fiscal and monetary stimulus measures are exhausted.” Powell’s previous testimony in Congress also indicated that , The Fed is currently more inclined to control inflation than to reduce the unemployment rate.

On the other hand, the market is still very concerned about the new variant Omicron. People are worried that the virus will spread faster than the Delta variant.

On Friday, health officials in the United States reported that approximately one-third of the 50 states in the United States have been infected by the Omicron variant virus. In an interview with the media, Dr. Fauci, the Chief Epidemic Prevention Advisor of the White House, said that so far, Omicron does not seem to be serious, but it is still too early to draw a conclusion and more research is still needed. In the past 7 days, the average number of new confirmed cases in the United States reached 119,000, and nearly 1,300 people died of new coronary pneumonia every day.

As more Omicron cases appear in the United States, US health and regulatory agencies have promised to speed up the review, but this may still take several months. Vaccine manufacturer Moderna previously stated that it will take 7-10 days to collect key data. Subsequently, it will take 60-100 days to deploy Omicron's vaccine. It is expected that the United States will not approve the production of new vaccines until March next year at the earliest. It will take longer to expand production.

Finally, there seems to be a voice in the market that the surge in VIX amidst the volatility of US stocks should not be a reason to deter investors. Because data shows that since 1990, there have been 19 transactions where VIX has soared by 40% or more. Of these 19 transactions, 18 times, the S&P 500 index has risen in the following year, and the average increase has been as high as 20%. However, we want to remind investors that it is difficult to expect it to rise by another 20% when the U.S. stock market has soared by 20%.