The Fed is expected to raise interest rates early. Will these three stocks benefit?

U.S. President Biden nominated Powell for re-election as Fed Chairman earlier this week, and another candidate, Brainard, was appointed as Fed Vice Chairman. This news boosted market expectations for the Fed to raise interest rates next year, and by then, the Fed will also end its bond purchase program.

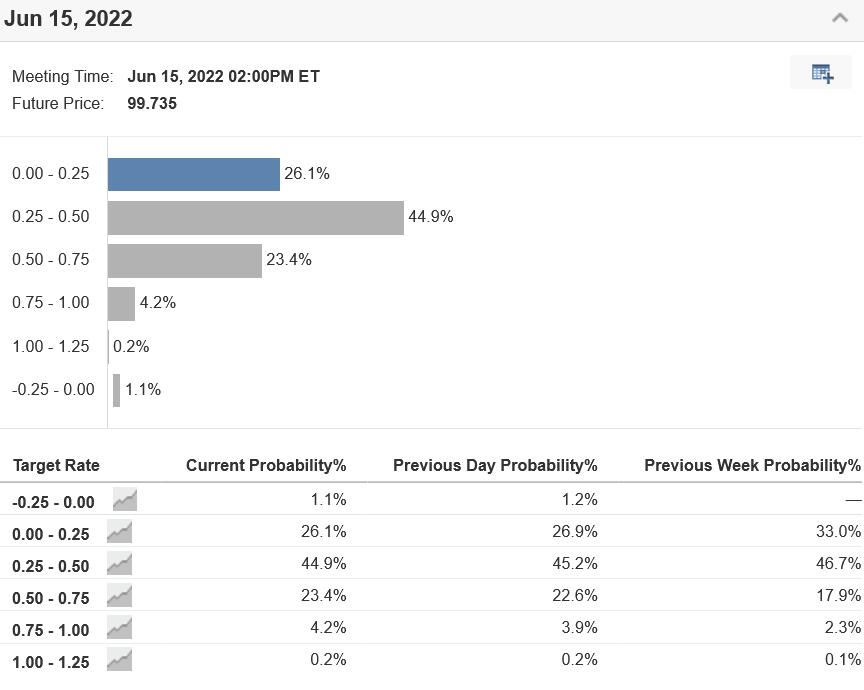

In fact, futures contracts linked to the Fed's interest rate policy indicate that the money market currently expects the Fed to raise interest rates by 25 basis points as early as June 2022.

In this context, this article will focus on three companies that have performed well this year and will “take a higher level” during the Fed’s tightening process:

1. Morgan Stanley

Share price performance so far this year: up 48.6%

Total market value: $182.8 billion

Morgan Stanley performed well this year. Benefited from economic recovery, active investment banking, booming IPO market and narrowing exposure to credit losses, the New York-based investment bank’s share price has risen by nearly 49% this year. Far exceeds the comparable returns of the Dow Jones and S&P 500 indexes.

Morgan Stanley's stock price closed at US$101.86 on Tuesday, not far from the all-time high of US$105.95 set on September 28. At current levels, the market value of this investment banking giant with total assets of US$1.1 trillion is about 1828. One hundred million U.S. dollars.

As more and more people bet that the annual interest rate will rise, Morgan Stanley's stock seems to be a reliable investment when buying in 2022. Higher interest rates and yields tend to increase the net interest margin that banks obtain from loans—that is, the difference between the interest income generated by the bank and the amount of interest paid to depositors.

On October 14, Morgan Stanley announced its third-quarter performance report. The data exceeded market analysts' expectations, thanks to the strong performance of its investment banking business and record-setting asset management expenses.

More importantly, in recent months, the Wall Street giant has stepped up its efforts to return more cash to shareholders through increased dividends and stock repurchases.

Also pay attention to: JPMorgan Chase (NYSE:JPM), Bank of New York Mellon (NYSE:BK), Bank of Zion (NASDAQ:ZION).

2. Nasdaq

Share price performance so far this year: up 56.6%

Total market value: 34.8 billion U.S. dollars

Nasdaq's stock price has risen by nearly 57% this year. As investors expect interest rates to rise in 2022, Nasdaq's stock price is expected to appreciate further in the next few months.

As one of the world's leading stock exchange operators, Nasdaq owns the Nasdaq Stock Exchange. In addition, this financial services company also owns the Philadelphia and Boston Stock Exchanges, as well as seven European exchanges.

Whether in a market environment with high interest rates or low interest rates, Nasdaq can generate stable returns. Rising interest rates are considered to be detrimental to many high-growth technology stocks listed on their exchanges, which may lead to increased trading activity and higher fees.

Nasdaq’s stock hit an all-time high of US$214.96 on November 5 and closed at US$207.91 on Tuesday, bringing the market value of the New York-based multinational company to US$34.8 billion.

Nasdaq announced its impressive third-quarter results on October 20. Due to the surge in the number of IPOs and strong demand for its services, its earnings and revenue exceeded expectations. In the July-September quarter, the exchange operator ushered in 147 newly listed companies, including popular stocks Robinhood Markets (HOOD), Duolingo (DUOL) and Freshworks (FRSH).

Nasdaq has been committed to diversifying its business. After acquiring Verafin for US$2.75 billion earlier this year, the company has become a major player in the field of anti-financial crime software, which bodes well for the company's future. Moreover, the company also provides a cloud-based market service platform to provide infrastructure for the market.

Also pay attention to: Standard & Poor's Global (NYSE: SPGI), Chicago Mercantile Exchange Group (NASDAQ: CME), Intercontinental Exchange (NYSE: ICE).

3. Apple

Share price performance so far this year: up 21.6%

Total market value: $2.65 trillion

In recent weeks, Apple's (NASDAQ:AAPL) share price has soared, hitting record highs repeatedly, as the market expects the tech giant to develop its own electric car, and demand for the company's flagship model iPhone 13 has set a record.

Apple’s share price hit a new high of $165.70 on Monday, up about 22% so far this year, and closed at $161.41 on Tuesday. At current levels, the Cupertino, California-based technology giant has a market capitalization of US$2.65 trillion, making it the company with the highest market capitalization on the American Stock Exchange.

Although Apple is widely defined as a growth stock, this consumer electronics conglomerate is not as susceptible to interest rate hikes as other technology companies because of its reliable profit model. Apple's annual revenue for fiscal 2021 increased by 33% year-on-year to 366 billion U.S. dollars, and its cash reserves also reached 191 billion U.S. dollars. With this in mind, even if traders increase their bets on a US interest rate hike next year, Apple will still benefit in the coming months.

However, it should be noted that Apple’s fourth-quarter revenue was lower than expected, but earnings were in line with expectations. Apple Chief Executive Cook blamed Apple’s supply chain problems for the decline in sales, which he warned would limit the production of iPhone, iPad and Mac computers.

Nonetheless, Apple predicts that with the strong growth of its service business, the crucial December holiday sales season will be the largest quarter in the company’s history, which includes subscriptions from the App Store, music and video subscription services, extended warranty periods, and authorization. And advertising sales.