Will Nvidia, who started the meta universe, be the next trillion-dollar club member?

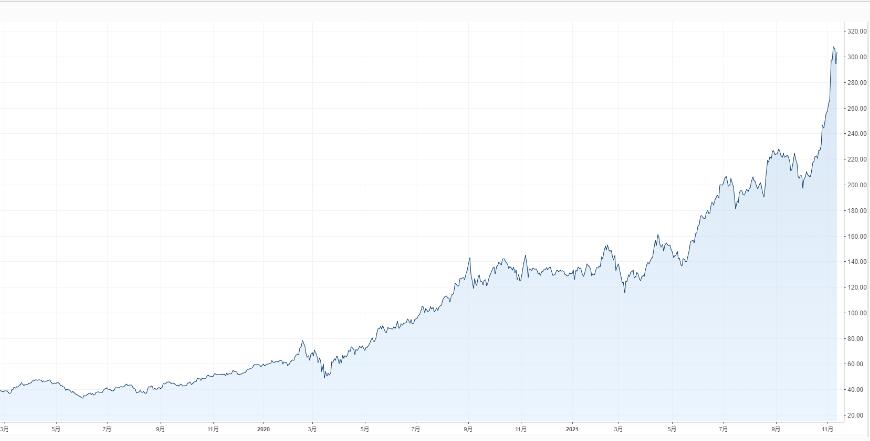

One stock has doubled in half a year, and has soared 10 times in three years, and its current market value exceeds 750 billion U.S. dollars. This bullish stock is exactly Nvidia (NASDAQ:NVDA), a semiconductor giant that is making progress toward a trillion-dollar market value.

Overvalued?

Many people think that Nvidia’s valuation is too high. At present, its market value ranks eighth among all US stocks. The top six have a market value of more than one trillion U.S. dollars. The seventh place is Facebook, which has just been renamed Meta, with a market value of 911.7 billion U.S. dollars. .

Nvidia’s price-to-earnings ratio exceeds 100 times, the highest among the top eight except Tesla, and it is also 5 times that of the US S&P 500 Index; net profit and earnings per share are compared with the previous companies It's also a small baffle, Nvidia's fundamentals don't seem to be good enough to support such a high valuation.

But it is undeniable that Nvidia is a high-growth company. The company's revenue has set a record high for 5 consecutive quarters, among which data center revenue has set a record high for 7 consecutive quarters. Next Wednesday, Nvidia will announce its latest financial report, and it is believed that there is a high probability that it will exceed market expectations.

Chip shortage

The global automotive chip shortage that began at the beginning of this year has spread to many manufacturers. Toyota, Ford, General Motors, Hyundai and other major automobile manufacturers have been affected. Over time, consumer electronics products such as smart phones and notebook computers have also suffered chip shortages. Many industries are trapped by the shortage of chips. Chip manufacturers such as Taiwan Semiconductor Manufacturing Co (NYSE: TSM) and American Advanced Micro Devices (NASDAQ: AMD) are making a lot of money.

In this round of chip shortages affecting many industries, NVIDIA has also been affected. Nearly half of their revenue comes from gaming graphics cards, but due to the shortage of chips caused by the epidemic, their current chip supply is still insufficient.

Nvidia CEO Huang Renxun also said that he believes that next year demand will still be much higher than supply, and they do not have a panacea to solve supply chain problems.

But the good news is that NVIDIA is fortunate to have a large number of supplier support, and its supply chain is also diversified. NVIDIA has a huge ecosystem support. The shortage of chips will have a certain impact on it, but the impact is generally controllable.

Meta universe becomes a new growth point

Recently, Metaverse has become a hot spot in the market.

The so-called meta universe is a new species formed by a combination of multiple technologies, including AR/VR, cloud computing, AI, 5G, and so on. This requires superb software technology, and it is naturally inseparable from excellent hardware technology. Since Metaverse is a bit like an online game, everyone has paid more attention to the direction of software before. Now the capital market has begun to pay attention to the field of hardware.

Nvidia has already released a public beta version of its open virtual platform Omniverse in December last year. Omniverse provides the foundation of the virtual world, allowing more than 700 companies and 70,000 individual creators from different industries to accurately replicate things in the real world in a virtual world, that is, "digital twins." For example, a designer can continuously improve his work in the digital world before bringing it to the real world. Richard Kerris, vice president of Omniverse platform development, also emphasized that Omniverse's goal is to make "two dimensions" connected and work together in unison.

This platform may become the cornerstone of Meta Universe, providing customers with strong hardware support.

Nvidia's recent surge is largely due to the explosion of the meta universe. Wells Fargo even claimed that Meta Universe will provide Nvidia with a value-added market share of US$10 billion in the future because Nvidia will be the hardware portal of Meta Universe. Wells Fargo also raised Nvidia's target price by about 30%, from a target price of US$245 to US$320.

Other investment banks have also upgraded Nvidia's rating. Bank of America raised its target price to US$340; Bank of Montreal raised NVIDIA’s target price to US$375 and maintains an outperform rating; Oppenheimer Funds also maintains NVIDIA’s outperform rating, with the latest target price of US$350.