Why does Delta virus not threaten US stocks?

Wall Street seems to have become the only corner of the United States that is completely immune to the new crown virus. In the past month, the number of confirmed cases of the new crown in the United States has increased fourfold, while the Dow has set a record high five times.

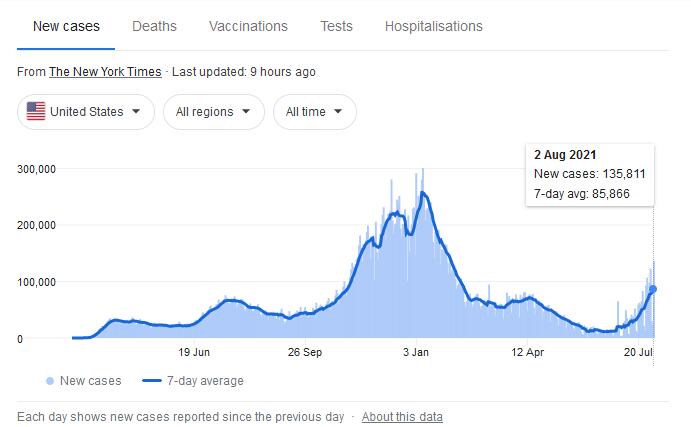

On Monday, the Centers for Disease Control and Prevention (CDC) released data showing that the number of new crown cases in the United States reached 72,790 last Friday, surpassing the peak of 68,700 in the summer of 2020.

Six US Western Bay Area counties and cities, including San Francisco, once again asked people to resume their order to wear masks indoors, and New York Mayor Bill de Blasio also "strongly recommended" people to wear masks indoors. New York Governor Andrew Cuomo announced that transport employees who have not been vaccinated in metropolitan areas will undergo weekly nucleic acid tests. In the past week, an average of more than 2,400 people in New York State tested positive for the new crown every day, higher than the number of new cases of about 300 people every day at the end of June.

The Delta virus does have some impact on the US stock market, and the three major stock indexes have been suppressed to varying degrees. But overall, the impact is not big, the S&P 500 index even rose to near all-time highs in early trading on Monday. Strategist Kristina Hooper pointed out that the spread of the delta strain has no significant positive effects on the market, such as the Fed’s loose monetary policy and effective vaccines. "The overall outlook remains positive, and Delta has not brought much change."

Although the Delta virus once again brought a new outbreak of virus transmission to the United States. However, with the increase in the number of infected people, the U.S. stock market has not been affected much.

On July 19, the average number of new cases in the United States in seven days was 35,000, an increase of 50% from the average seven days in the previous week. The Dow Jones Industrial Average fell 2.1%, the biggest one-day drop since October last year, while the US Standard & Poor's 500 Index also fell 1.6%.

However, since then, US stocks seem to have quickly recovered. Even if the infection situation is still getting worse, as of Monday, the average number of new cases in the United States in the seven days is about 80,000, an increase of 129% from the seven days as of July 19. The U.S. stock market was the first to return to life.

You can easily come to the conclusion that Wall Street investors no longer care about the crisis that the new crown epidemic may bring.

First of all, despite the emergence of the new crown epidemic, investors are optimistic about the profitability of US stock companies and the prospects of the US economy in the second half of 2021.

On Sunday, U.S. senators announced a nearly $1 trillion bipartisan infrastructure package after a long delay. As a key part of Biden's agenda, the bipartisan bill is the first phase of the president's infrastructure plan. It requires new expenditures of US$550 billion higher than projected federal levels within five years, which may be one of the larger expenditures on national roads, bridges, water supply projects, broadband and power grids over the years.

Although the 6.5% economic growth rate in the second quarter was lower than expected, the economic outlook for the rest of this year remains solid. Goldman Sachs analysts wrote in a research report that corporate inventories are 10% lower than the pre-epidemic level, which means that the US$275 billion shortfall will need to be filled in the next few quarters.

In addition, the rebound in corporate profits has also boosted investors' confidence in more US stocks, even though the market is currently close to record levels. According to data from FactSet, 88% of the S&P 500 companies that have announced earnings exceeded expectations. FactSet predicts that S&P 500’s total profit growth in the second fiscal quarter is expected to reach 85.1%, which will be the highest growth rate since 2009.

Second, the market also believes that the surge of new crown cases in the United States is limited to the country and will not trigger a large-scale blockade again.

During the same period, the average number of new cases in the world in seven days was 596,000, an increase of about 15% over the seven days as of July 19. Excluding data from the United States, the world averaged about 517,000 passengers per day for seven days, a 6% increase from the level on July 19. Among them, the epidemic in the UK has slowed down considerably. This is obviously much better than the 129% increase in the United States.

In this context, Wall Street investors have reason to believe that a large-scale blockade will not happen again.

Fed Chairman Powell said last week that Americans may face some restrictions on eating and going out, but with the further promotion of vaccination, in each subsequent wave of infections, the economic damage caused by the epidemic is expected to be reduced. . He told reporters, "We have learned how to deal with these situations, and the impact does not seem to be too great."

Finally, and most importantly, for most investors, the biggest driving force of the stock market has not disappeared, that is, the Fed's ultra-loose monetary policy.

Since the outbreak of the epidemic in March 2020, the U.S. monetary environment has been maintained at a super-easy state, and this has almost killed bond returns. At present, around the world, there are about 16 trillion U.S. dollars in return on assets that are negative. This makes US stocks the only market worth investing in. In the past year, the Dow Jones Index jumped more than 32%, while the Nasdaq Composite Index, the main technology stocks, rose 40%.

Moreover, data shows that there is still no shortage of funds in the market outlook. Americans hold up to $4.5 trillion in risk-free money market mutual funds, which is more than twice the long-term average. Americans’ savings as a percentage of disposable income are also much higher than before the epidemic. Mike Lewis, Barclays' head of U.S. stock trading, pointed out that “people don’t have much to go, and they don’t have much choice but to invest in stocks. And they have a lot of cash.”

However, it is undeniable that "Delta anxiety" still exists on Wall Street, and investors have to pay attention.

JPMorgan Chase’s market strategist wrote in a report on Monday: “Delta mutant strains will be a direct threat to the prospects of US stocks.”